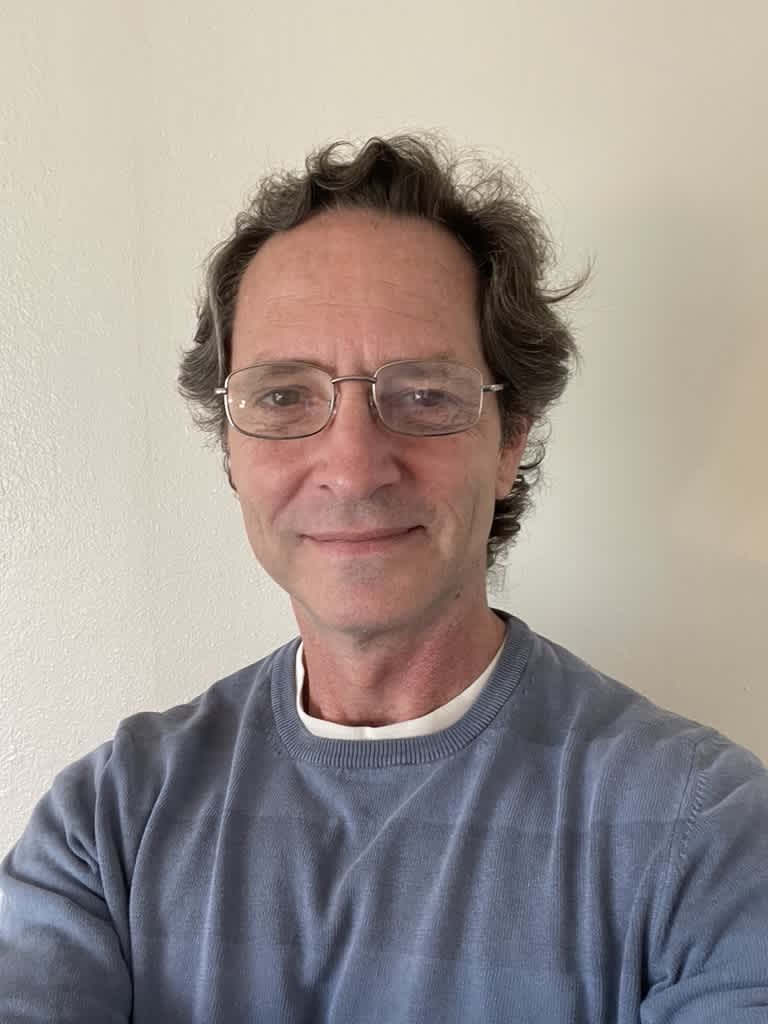

Tutorial: How to organize your account plan using multiple wallets on Emerald.

1. What Is an Account Plan?

An account plan is a system where you use your financial accounts to separate your money in categories to organize your finances more effectively.

Millions of individuals, households, self employed, and small businesses worldwide conveniently use this system to manage their money.

In this tutorial we will present an example for a charity receiving donations in crypto.

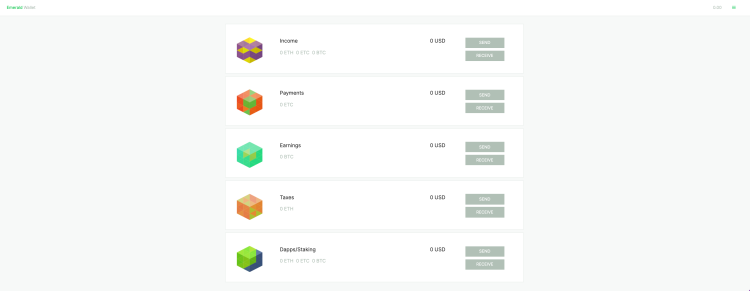

2. Multiple Wallets on Emerald

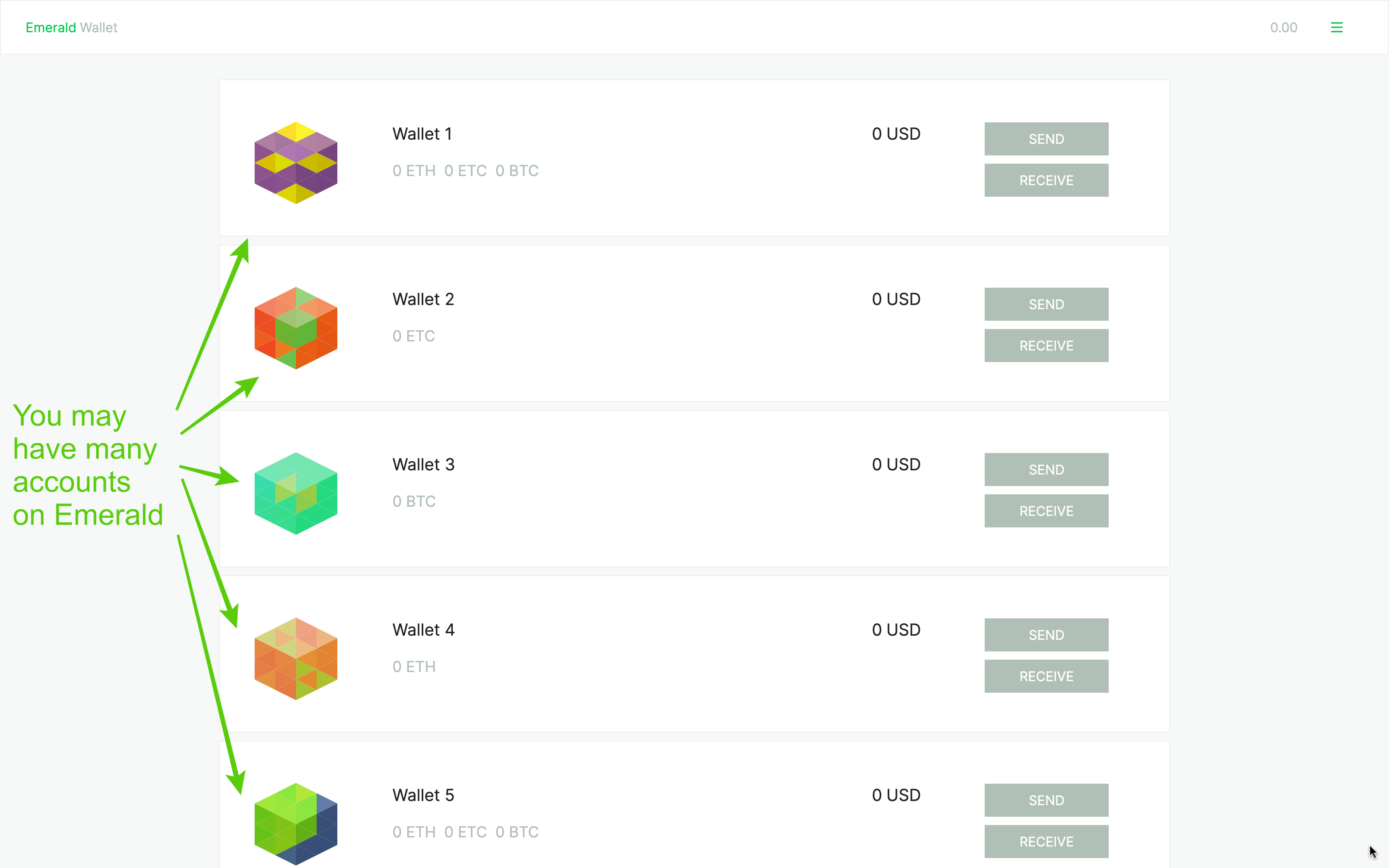

First, let's start by explaining that Emerald supports multiple wallets. This means you can create your first wallet when you download Emerald (there are different ways of creating accounts explained in our other tutorials) and from there you can create more wallets at your convenience to manage your money in categories.

Below is an example of several wallets created using Emerald Wallet.

The cool thing is that you can actually name your wallets whichever way you want, so it is most convenient to manage your finances!

3. Example of a Charity Receiving Donations in Crypto

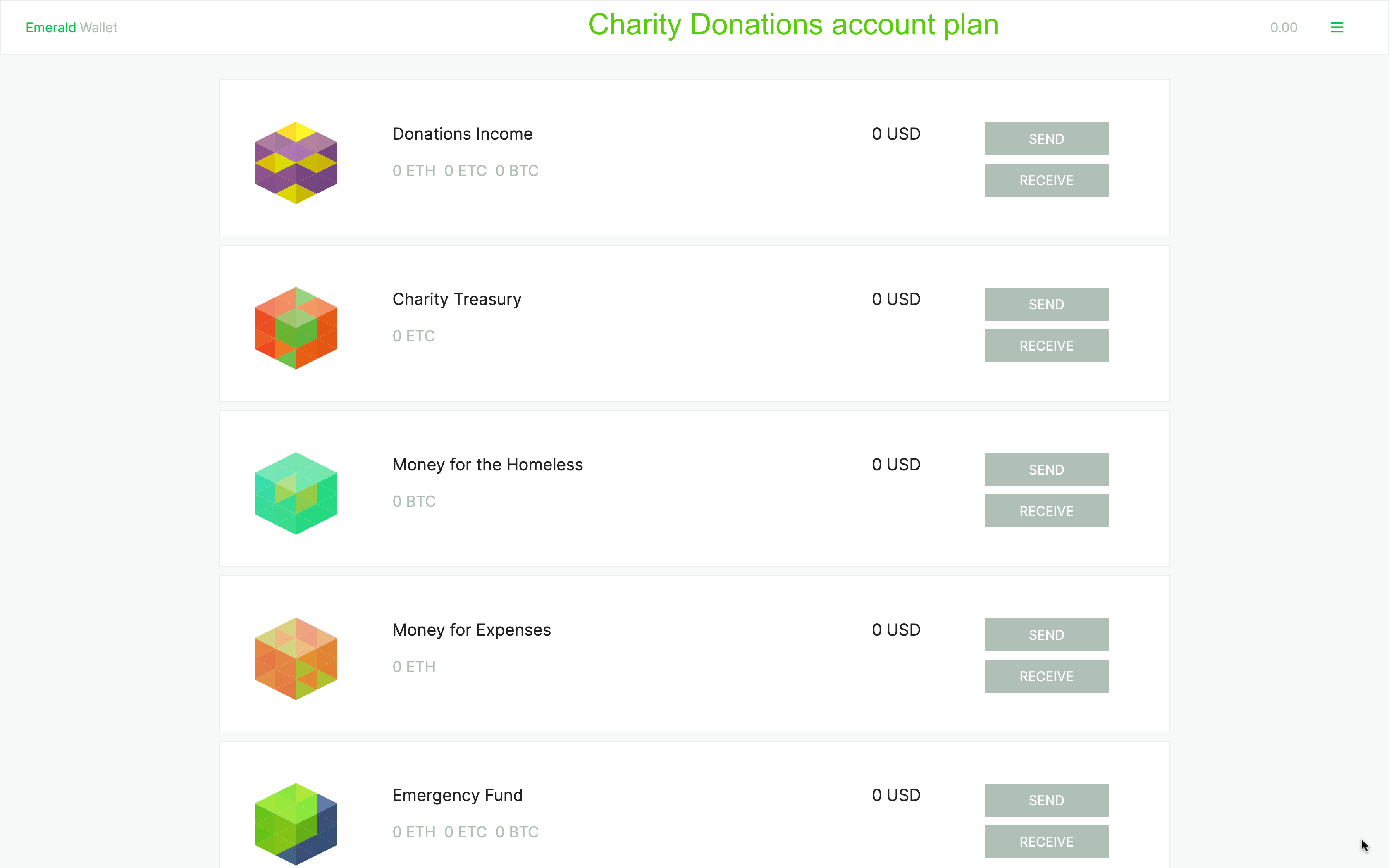

For example, a charity; who may be a small organization that helps the homeless in their local community, run by a social worker, receiving donations in crypto from several countries; may have the following account plan:

The logic of this account plan for a charity receiving donations in crypto is the following:

a. Donations Income

To keep track of their income from donations in crypto, our charity may create a "donations income" wallet specifically for that purpose. This is useful to segregate those revenues and to isolate them for administrative purposes. Also, it may be convenient to better organize invoice and receipts to donors.

b. Charity Treasury

Usually, a significant part of the income of charities is destined to a treasury that is accumulated for long term investment to guarantee future aid to their beneficiaries. Because this money is usually managed in a particular way, it may be very convenient to separate it in a specific wallet.

c. Money for the Homeless

The portion of incoming donations, that goes to beneficiaries in the short term may be segregated in a special wallet. This is useful to track current payments to the homeless in the local community.

d. Money for Expenses

As charities may be normal operations with normal expenses; such as staff, utilities, computer outlays, subscriptions, rent, communications, and others; they may want to separate part of their income donations into an account dedicated to pay for their monthly bills.

It is convenient to keep track and segregate this kind of expenses, as opposed to the money that goes to their beneficiaries, because it is usually important when it comes to formal regulatory and tax exemption reporting.

e. Emergency Fund

To accumulate some cash to pay for the "money for expenses" above, in case in some periods donations may dwindle, charities may want to create an "emergency fund" wallet. This may be to reserve funds to guarantee their continued operations. Emergency funds usually cover from 3 to 6 months of operations expenses.

Note the "emergency fund" is to pay the charity's short term expenses in case of a lack of donations for a while. They are not for future aid to the beneficiaries, which is the "charity treasury" wallet above.

Both of these funds would have very different investment styles as the emergency fund would usually need to be much more liquid and stable, and the charity treasury would be invested in long term and probably more volatile options.

4. Watch More Examples!

For more examples of account plans that may adjust to your personal needs, please watch this video:

Thank you!

To start using Emerald, download it here: https://emerald.cash/download