Tutorial: How to organize your account plan using multiple wallets on Emerald.

1. What Is an Account Plan?

An account plan is a system where you use your financial accounts to separate your money in categories to organize your finances more effectively.

Millions of individuals, households, self employed, and small businesses worldwide conveniently use this system to manage their money.

In this tutorial we will present an example for international remote workers or remote workers in general.

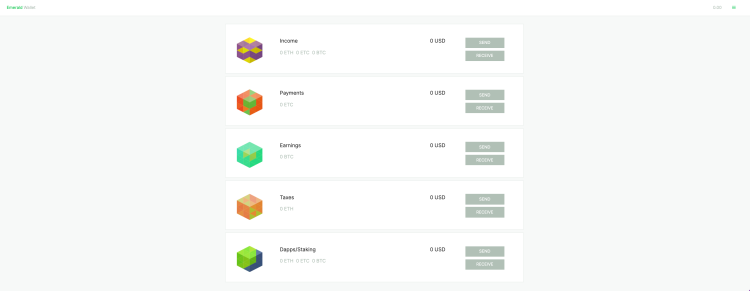

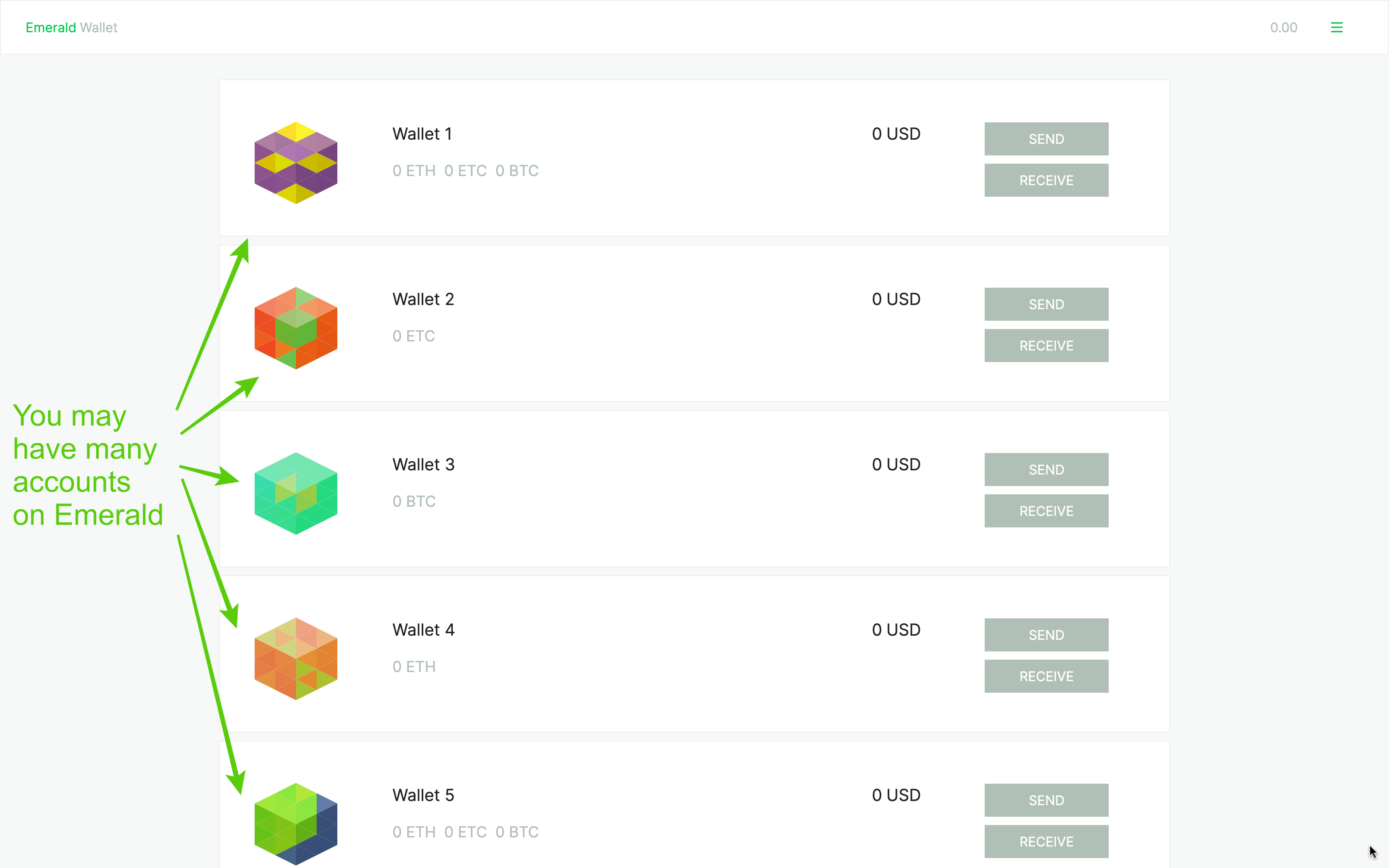

2. Multiple Wallets on Emerald

First, let's start by explaining that Emerald supports multiple wallets. This means you can create your first wallet when you download Emerald (there are different ways of creating accounts explained in our other tutorials) and from there you can create more wallets at your convenience to manage your money in categories.

Below is an example of several wallets created using Emerald Wallet.

The cool thing is that you can actually name your wallets whichever way you want, so it is most convenient to manage your finances!

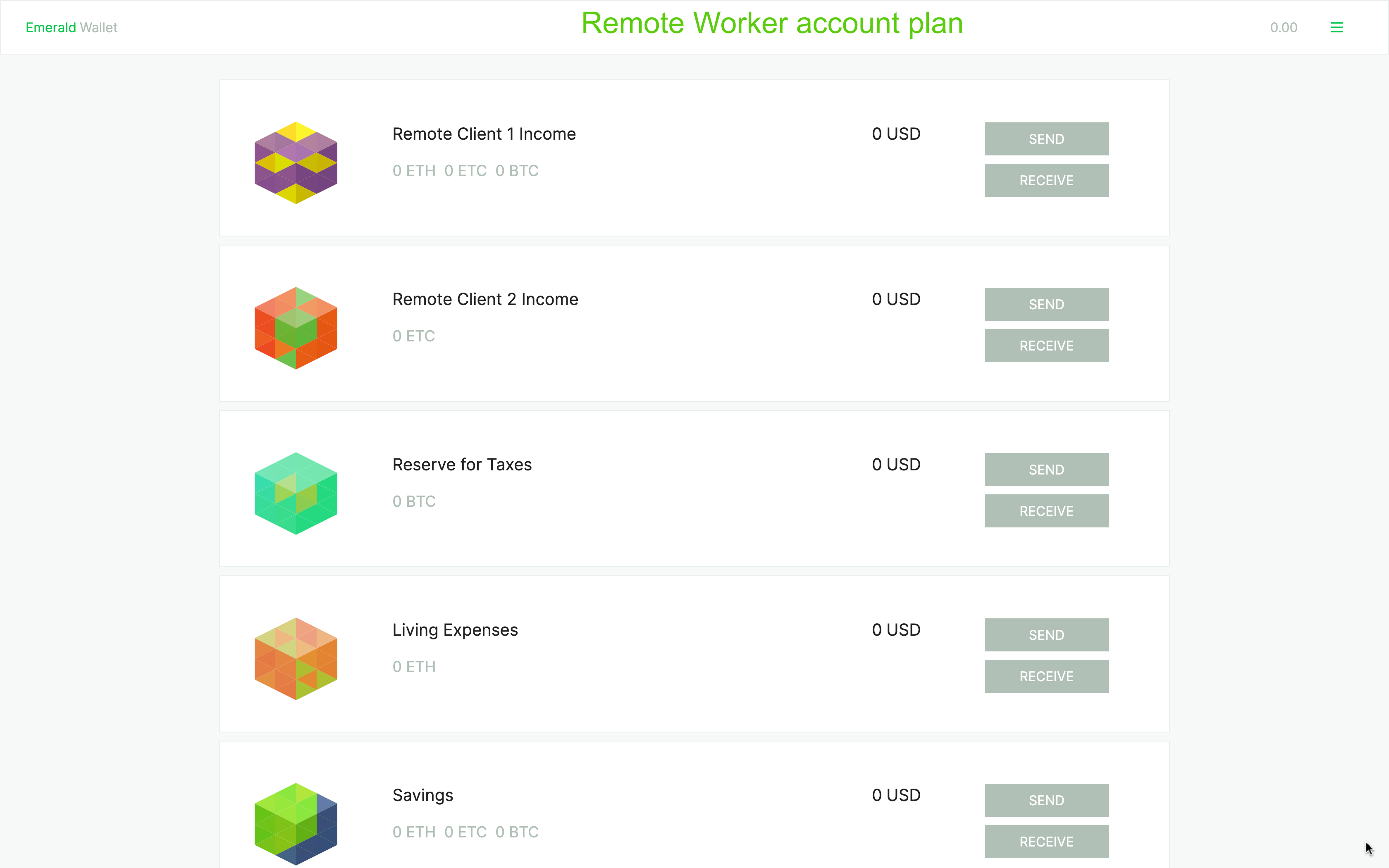

3. Example of an International Remote Worker Account Plan Using Emerald

For example, an international remote worker; who may be a developer, software engineer, help desk agent, sales person, researcher, data entry associate, or any of the many typical international remote worker roles; may have the following account plan:

In this case, our subject is an international remote worker; say, a software developer; who works part time for two companies; say, one in Europe and one in North America; and he receives regular payments from both clients; one may pay him weekly and the other monthly.

The logic of this account plan for an international remote worker (or any kind of remote worker, in any case) is the following:

a. Remote Client 1 Income Wallet

Because our international remote worker gets payments from two clients from different regions and in different frequencies; and to separate their payments, so it is more organized and easier to track; he/she has created one wallet inside Emerald for each client and gets the payments from them in each wallet. In this case, a wallet called "remote client 1 income" was created just for the payments received from the European client. This client pays on a weekly basis.

b. Remote Client 2 Income Wallet

To receive the payments from his/her North American client, our remote worker created another wallet called "remote client 2 income". In this case, the client pays on a monthly basis.

Now that the payments of both clients are segregated, it is much easier to control and track the payments from each client and this becomes useful information for administrative and organizational purposes.

c. Reserve for Taxes Wallet

As is common, all individuals, contractors, and self employed people, need to account for and go accumulating the money that would go to pay taxes when tax season comes. For this, it is convenient for remote workers to create a "reserve for taxes" wallet to segregate and go moving the estimated amounts to cover their future tax payments. As payments are received, remote workers can go moving a portion of this income into this wallet.

d. Living Expenses Wallet

Individuals, contractors, and self employed people, including remote workers, usually mix their business and personal finances. This may be cumbersome to organize. A neat way of solving this is by also moving the money expected to be spent in personal expenses into a segregated account called "living expenses", for example.

This may also be very convenient, so the other business expenses are separated and may be easier to identify to calculate tax deductions when tax season comes.

e. Savings Wallet

Finally, remote workers may also wish to save money for the longer term or for other goals. In the same way that they estimated their taxes and living expenses, and segregated those amounts, they can also estimate how much they can save on a weekly or monthly basis as they receive their income from their clients.

For this, a "savings" wallet may be convenient to go moving the savings money to that account. Then, this money may be invested in crypto or other assets or for whatever objectives one could have.

4. Watch More Examples!

For more examples of account plans that may adjust to your personal needs, please watch this video:

Thank you!

//