Tutorial: How to organize your account plan using multiple wallets on Emerald.

1. What Is an Account Plan?

An account plan is a system where you use your financial accounts to separate your money in categories to organize your finances more effectively.

Millions of individuals, households, self employed, and small businesses worldwide conveniently use this system to manage their money.

In this tutorial we will present an example for sole proprietors.

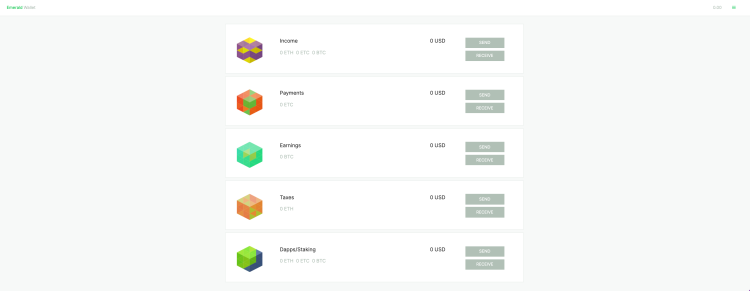

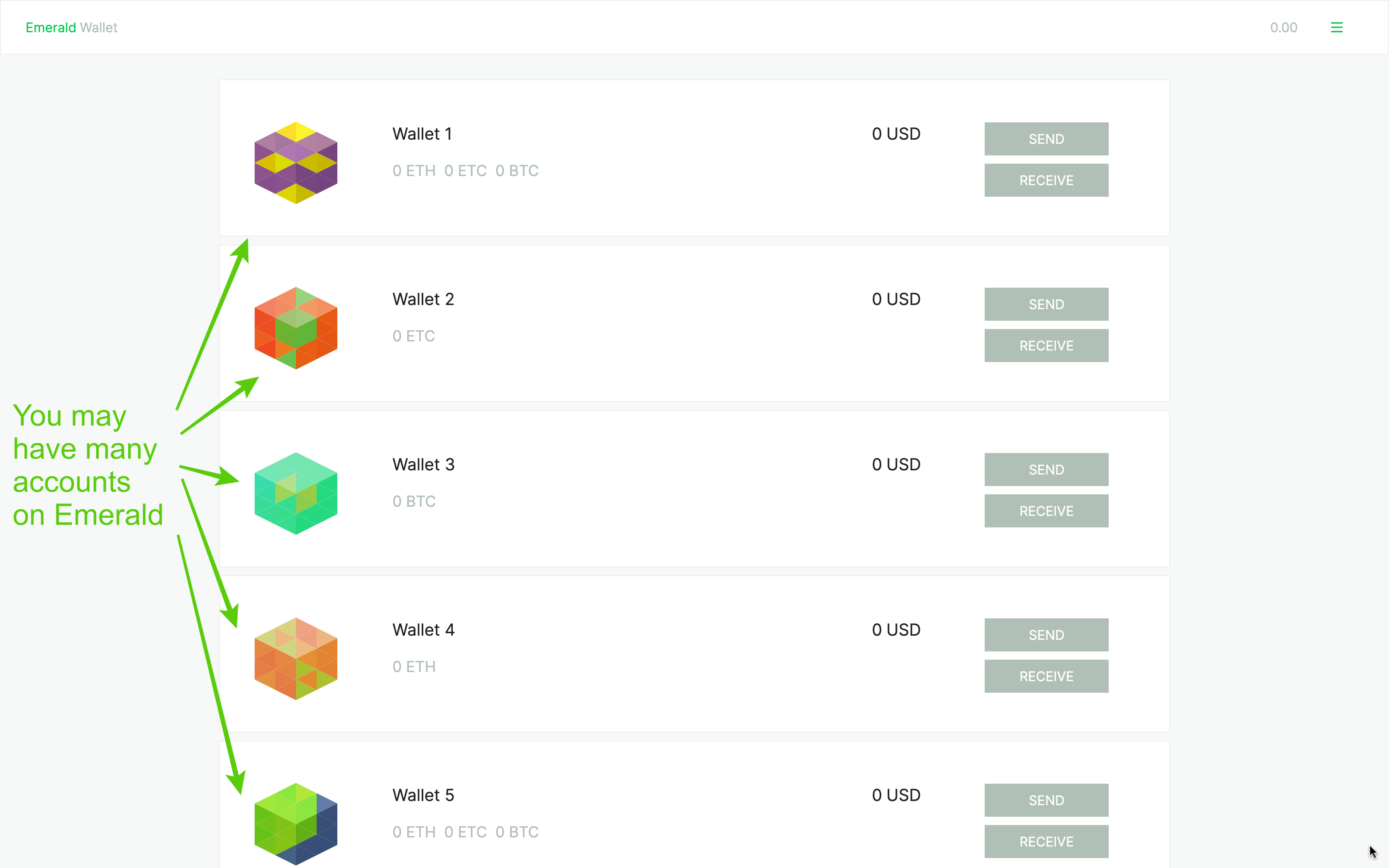

2. Multiple Wallets on Emerald

First, let's start by explaining that Emerald supports multiple wallets. This means you can create your first wallet when you download Emerald (there are different ways of creating accounts explained in our other tutorials) and from there you can create more wallets at your convenience to manage your money in categories.

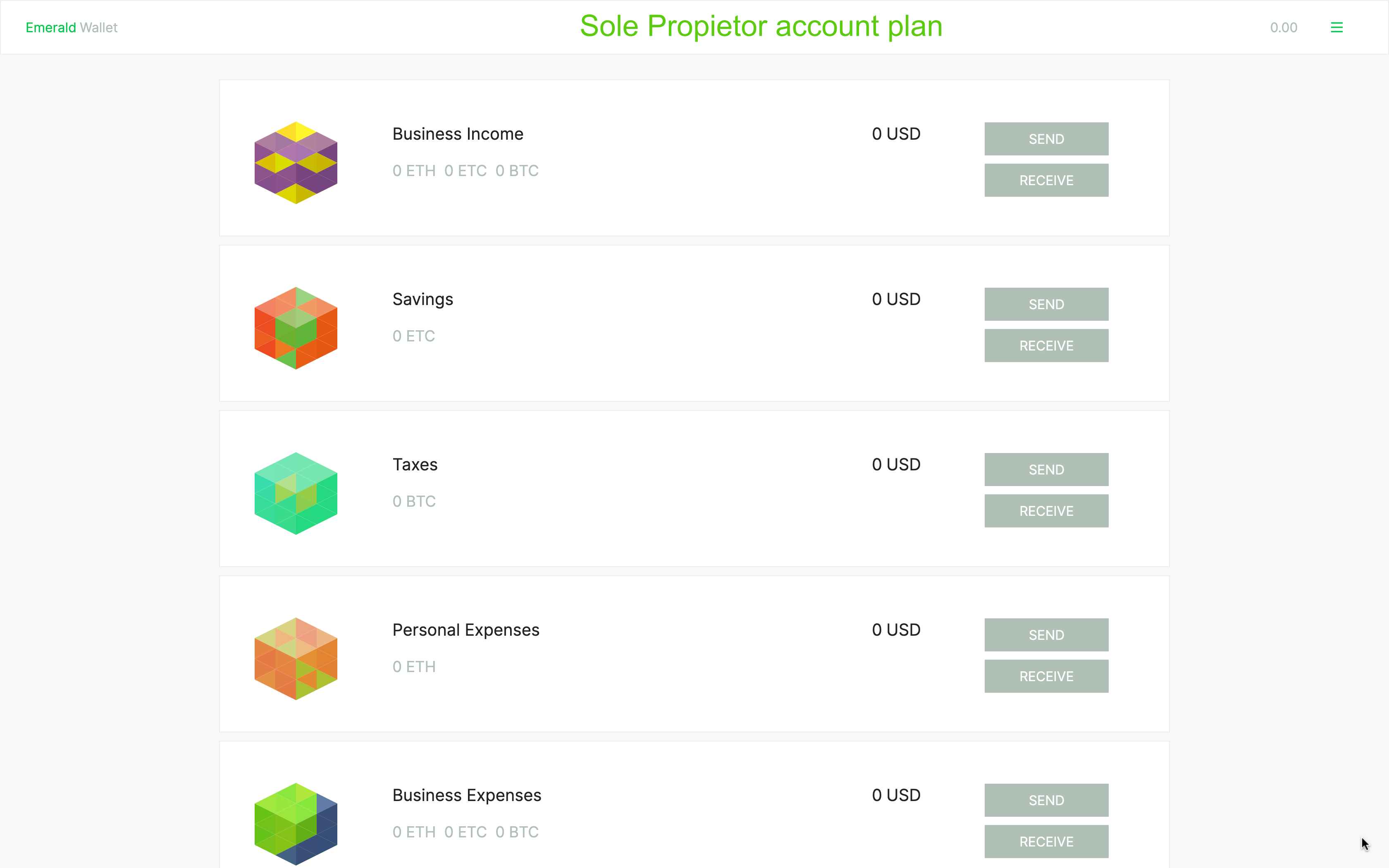

Below is an example of several wallets created using Emerald Wallet.

The cool thing is that you can actually name your wallets whichever way you want, so it is most convenient to manage your finances!

3. Example of a Sole Proprietor Account Plan Using Emerald

For example, a sole proprietor, who is basically a self employed person, may have the following account plan:

The logic of this account plan for a sole proprietor is the following:

a. Business Income Wallet

One way to organize a sole proprietor's income is by getting all the payments from all customers into the same wallet. This helps in tracking all the transactions in one place for all revenues.

b. Savings Wallet

Because self employed individuals usually mix their personal finances with their business money, it may be very convenient to move some money, or the money you know you are going to save in any given period, to a wallet labeled "Savings". This is convenient because it clearly separates that important part of the cash from the other daily and monthly movements.

c. Taxes Wallet

Another vey important compartment to have in a separate wallet may be the estimated taxes that a self employed person may have to pay in the future. This is convenient because many times the cash that should go to pay taxes gets lost in the flow of transactions and when tax season comes one may have already spent it in other things. This is why it may be very useful to separate estimated tax money as revenues come in to the business income wallet.

d. Personal Expenses Wallet

As said before, because sole proprietors tend to mix their personal and business money, and that may get confusing, it is very convenient to segregate the portion of the income that goes to personal expenses (rent, food, bills, utilities, schools, family vacations, etc.) in a different wallet and pay for those from there.

e. Business Expenses Wallet

For the same reasons as above, it may also be smart to separate the business expenses money (office rent, providers, employee salaries, computer supplies, wifi, online tools subscriptions, etc.) into another wallet. This is not only for practical purposes, but it is also very important for when tax season comes because, usually, the business expenses are tax deductible, so having them all in one wallet makes it easy to track and identify them.

4. Watch More Examples!

For more examples of account plans that may adjust to your personal needs, please watch this video:

Thank you!

//