An explanation of what are exchanges, centralized exchanges, and decentralized exchanges.

You can watch this educational content here:

In this Emerald educational post we explain what are exchanges, centralized exchanges, decentralized exchanges, and how decentralized exchanges work.

What Is An Exchange?

An exchange in the crypto industry; similar to stocks, currencies, or commodities; is a marketplace where buyers and sellers of crypto assets gather to match their needs (whether to buy or sell), negotiate a price (in exchange for what quantities they are willing to buy or sell), transact (to execute their exchange deals), and settle their transactions (proceed to delivery and final payment of their deals).

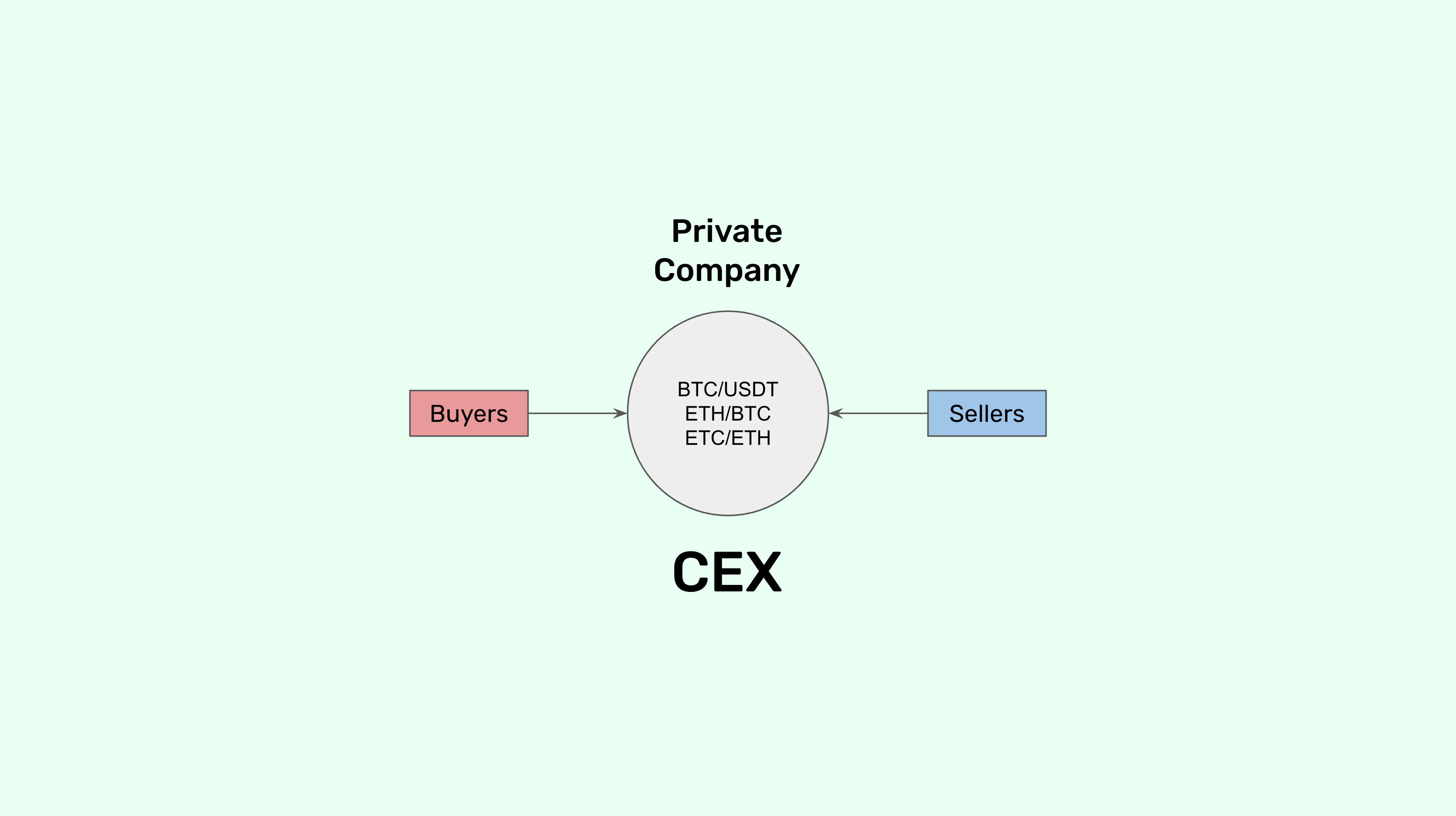

What Is A Centralized Exchange?

A centralized exchange (CEX) is a private company that dedicates itself to providing the marketplace for buyers and sellers to meet so they can exchange crypto assets.

In this type of service, the company runs all the systems, account openings and management, bids and offers, transactions, and settlements in their own private and centralized servers.

In this setting the company that provides the marketplace has total control of users’ accounts, custody of assets, and whether their clients are able to transact and transfer funds.

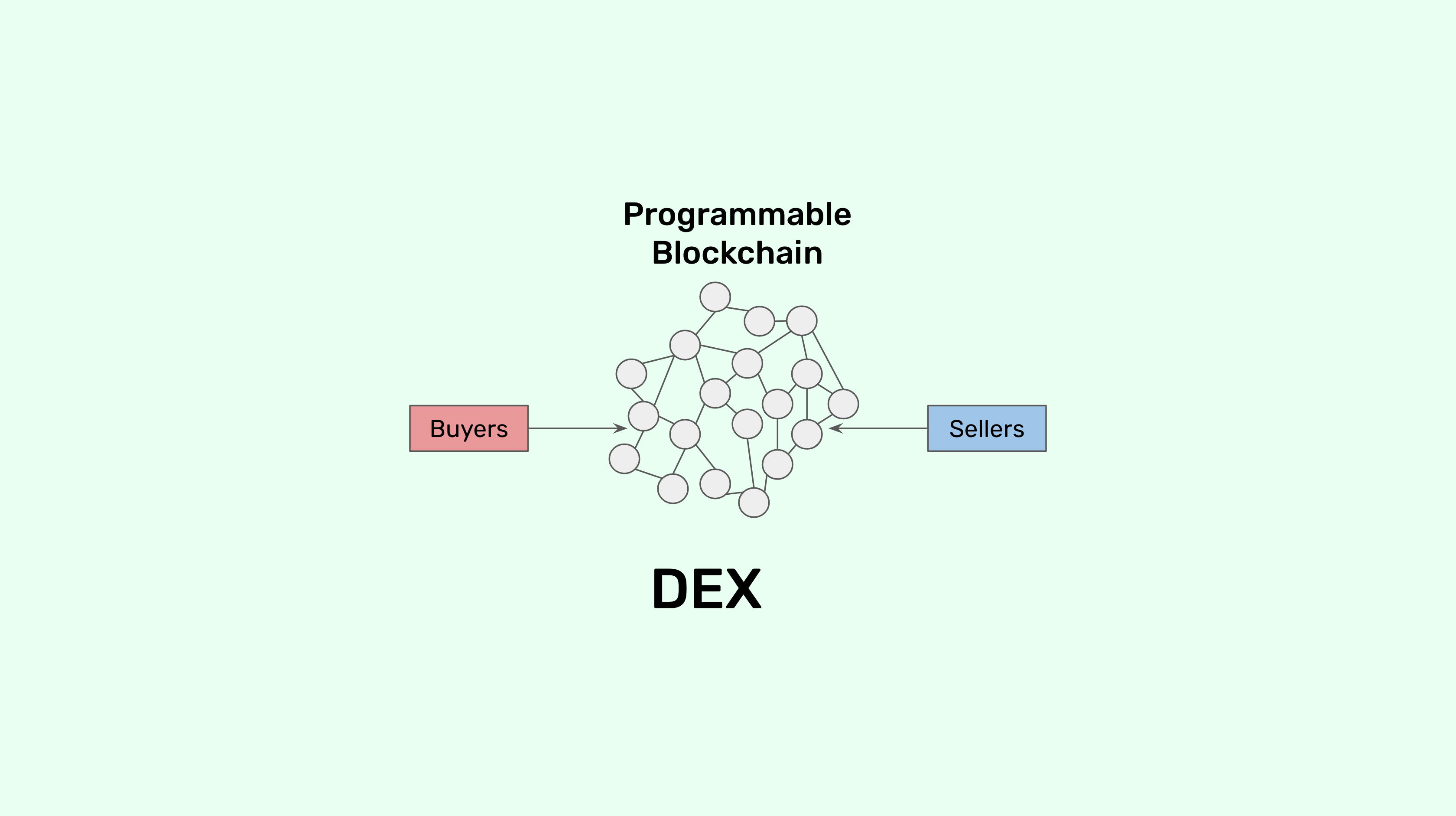

What Is A Decentralized Exchange?

A decentralized exchange (DEX) is a system of smart contracts inside a programmable blockchain that processes the transactions and settlements that buyers and sellers wish to execute between themselves.

Because these types of exchanges run on blockchains, they are decentralized and and do not filter who may enter transactions or transfers, and therefore are censorship resistant, permissionless, and deals have finality once processed by the network.

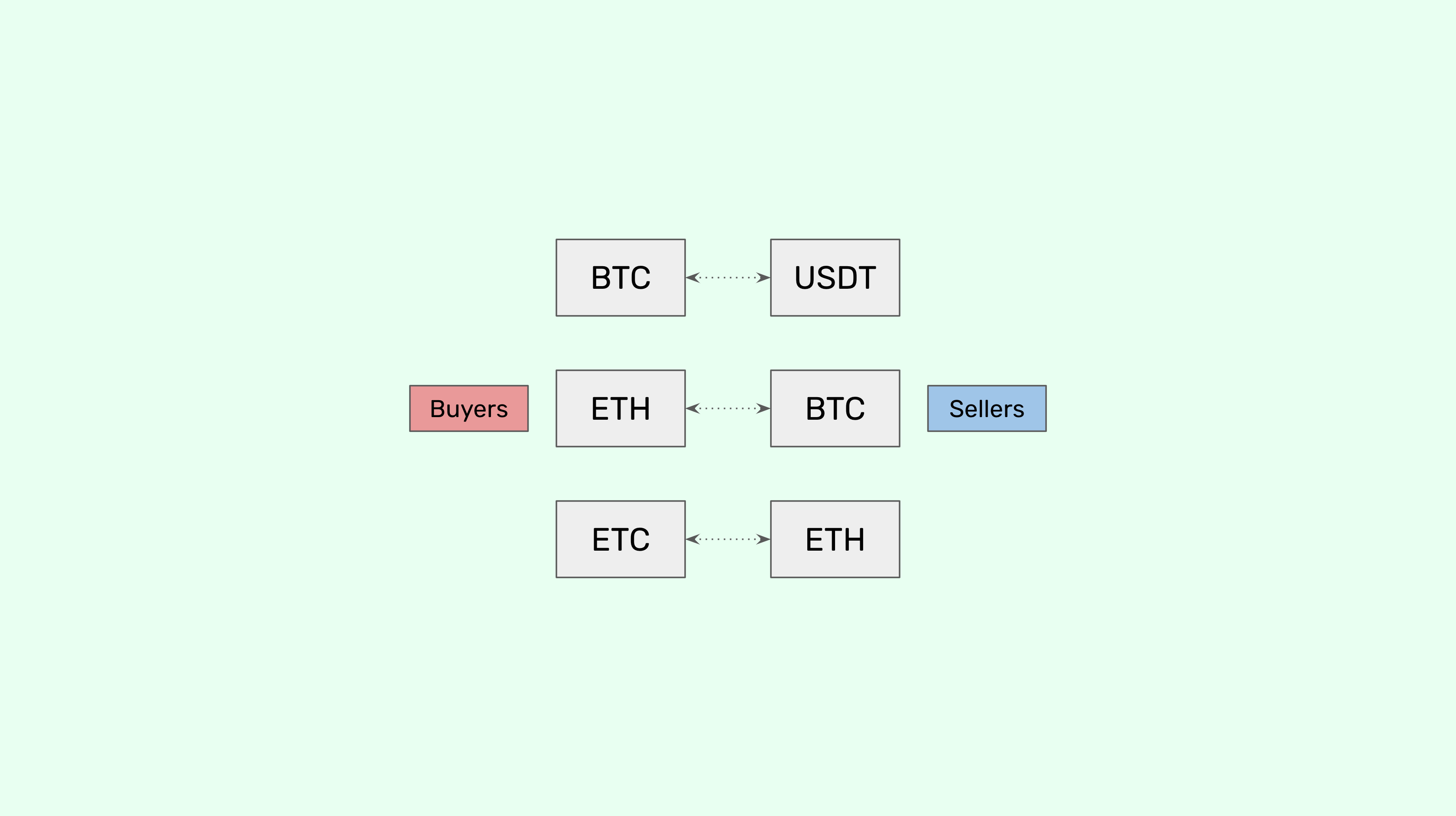

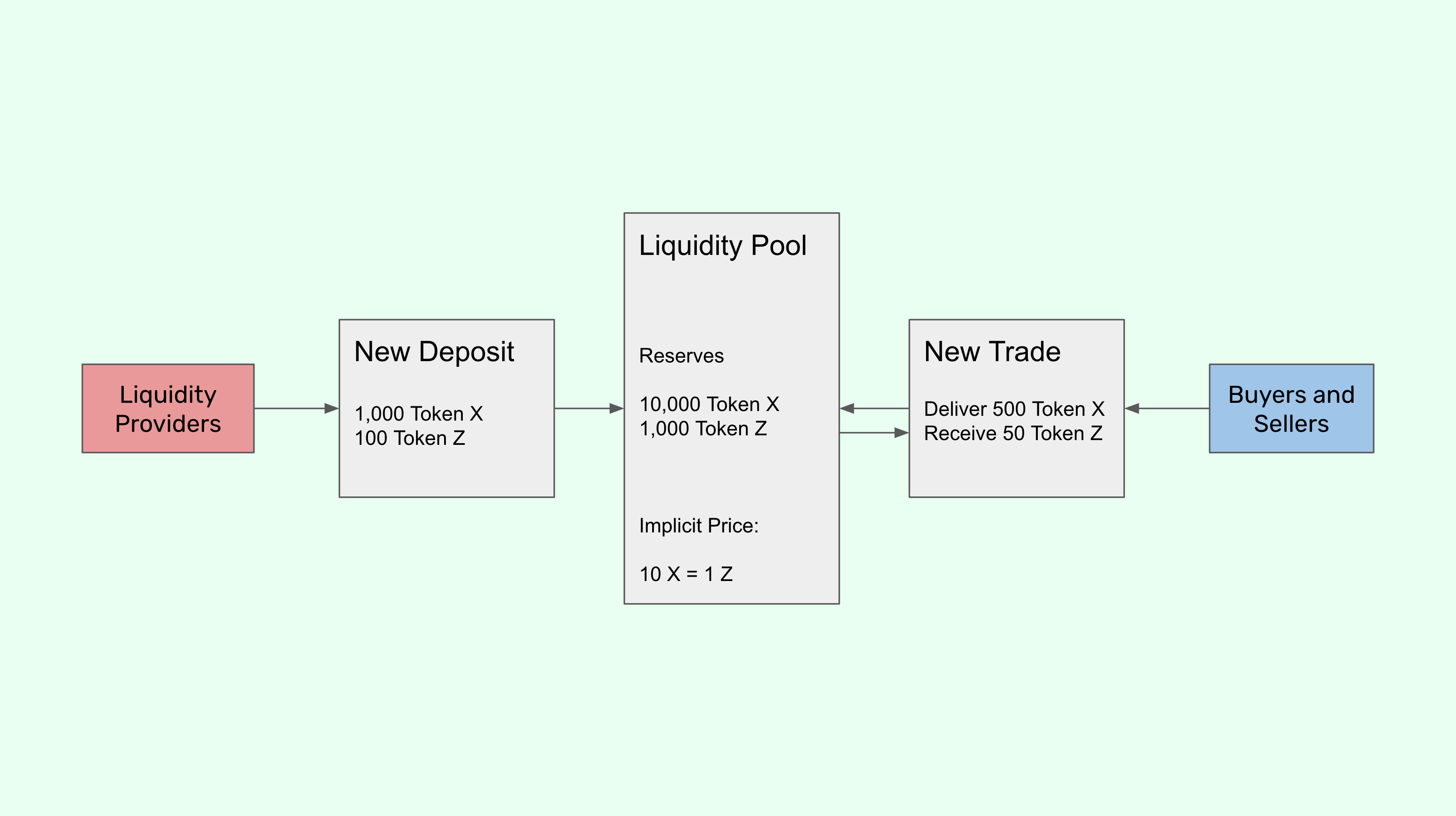

How Do Decentralized Exchanges Work?

DEXs have liquidity providers on one side and buyers and sellers on the other. Liquidity providers contribute reserves into liquidity pools with at least two tokens. The ratio between these tokens imply the current exchange price. Then, buyers and sellers may deposit one token to withdraw the other at the implied price.

In the example above, liquidity providers deposited a total of 10,000 of token X and 1,000 of token Z implying a ratio or price of 10 X per 1 Z. Then, a seller of token X entered a transaction where they delivered 500 of token X and received 50 of token Z, which is equivalent as a transaction to sell 500 at 10 X per 1 Z.

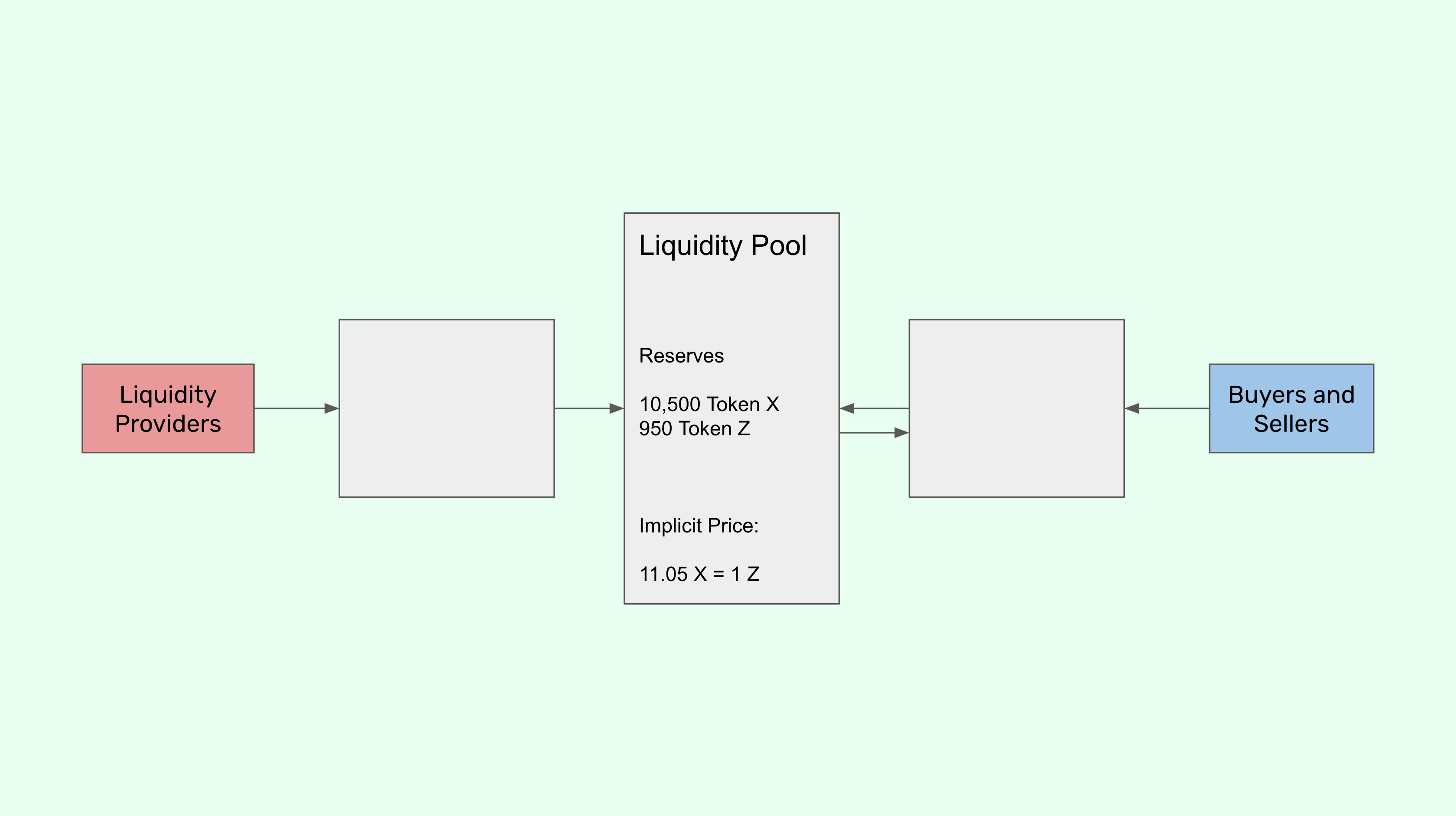

After the transaction by the seller was settled, then the balance of tokens in the reserves of the liquidity pool changed to 10,500 of token X and 950 of token Z. This implies a new ratio or price between these tokens of 11.05 X per 1 Z.

As this movement in the ratio or price from 10-to-1 to 11.05-to-1 may represent an arbitrage opportunity if the fair market value should still be around 10-to-1, then it is likely that either a liquidity provider will make new deposits to re-establish the ratio or buyers will do the reverse trade as previously entered and arbitrage the price back to 10-to-1.

Will Emerald Support Decentralized Exchanges?

Yes, very soon Emerald will integrate swaps and trades in decentralized exchanges on the blockchains we support.

Thank you for reading this post!

Please remember to download Emerald here: