How the Ethereum Classic supply works.

You can watch this educational content here:

Ethereum Classic’s monetary policy depends on six variables:

The premine

Eras

Block rewards

Block frequency

Uncle blocks

The fifthening

What Is the Premine?

Because Ethereum Classic and Ethereum were one chain at the beginning, they have the same premine: The co-founders did a crowd sale or presale of ether tokens in 2014 to raise money for 18 months of development. This presale amounted to 60 million coins. Additionally, they issued 12 million coins for the founders and developers themselves. All this means that 72 million ETH/ETC were issued in the first block. This is called the premine.

What Are the Eras?

After Ethereum forked away from Ethereum Classic in 2016 on block 1,920,000, the ETC ecosystem decided to establish an algorithmic and fixed monetary policy just as Bitcoin.

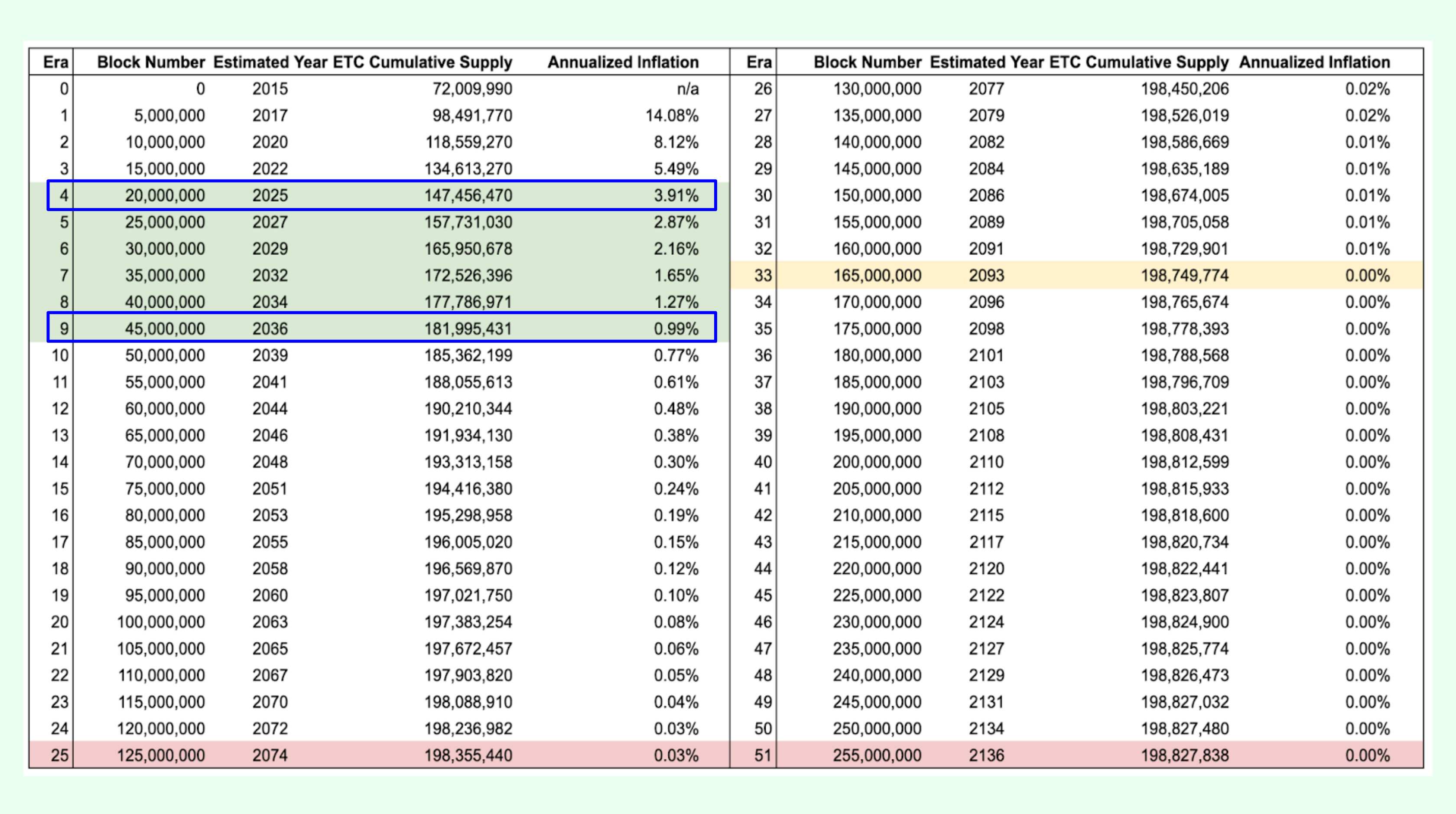

This monetary policy is divided in eras, and in each era there is a 20% discount in the miner block rewards. The eras last 5,000,000 blocks which is equivalent to 2.38 years.

The first few eras were as follows:

- Era 1: From block 0 to 5,000,000 the miner reward was 5 ETC per block. - Era 2: From block 5,000,001 to 10,000,000 the miner reward was 4 ETC per block. - Era 3: From block 10,000,001 to 15,000,000 the miner reward was 3.20 ETC per block. - Era 4: From block 15,000,001 to 20,000,000 the miner reward is 2.56 ETC per block (this is the current era).

And the eras will continue as above until the rewards diminish to zero by the year 2136.

What Are the Block Rewards?

As ETC is a proof of work blockchain, and to create blocks miners have to spend a lot of energy and capital in equipment and mining operations, they need to get paid to create new blocks.

Therefore, the Ethereum Classic network issues $ETC for miners and credits them in their account each time they create a block.

These are the rewards mentioned in the eras section above.

What Is the Block Frequency?

The frequency of blocks is how much time passes between blocks, or how much time it takes to create each new block.

The Ethereum Classic network is programmed so that the blocks take 15 seconds on average to be created. This means that miners get paid (thus new $ETC are issued) every 15 seconds.

What Are Uncle Blocks?

Because with a frequency of 15 seconds per block it is possible that more than one miner may have created a valid block for the network, then the ETC designers decided to pay a small fee to those miners, even if their blocks are stale and not used for the canonical history of transactions.

So, these miners get paid for their work, but their blocks are not part for the main blockchain. These blocks are called “uncle blocks”.

What Is the Fifthening?

As explained previously, in each era, and every 5 million blocks, which is equivalent to every 2.38 years, the ETC protocol discounts the payment to miners (and uncle blocks) by 20%.

Each time this event happens it is an important milestone because it lowers the inflation rate of the cryptocurrency.

These events are called the “fifthening” as 20% is a ⅕ discount to the block reward.

What Is the Annual Inflation Rate of ETC?

Both ETH and ETC started with a high inflation rate, but now ETC has lowered its dilution rate per year due to the fifthening process and will be near zero in the future.

As may be seen in the diagram above, the current inflation rate is 3.91% and will be less than 1% by the year 2036.

How Many ETC Will There Ever Exist?

Given the eras of ETC, the block rewards and frequencies, the discounts per era, the average uncle block rate, and the fact that it is divisible by 0.000000000000000001 (1e-18), then the ETC maximum supply in all of its history will be approximately 210,700,000 ETC.

Thank you for reading this educational post!

Please remember to download Emerald here: